The assassination of Iranian Revolutionary Guard general Qasem Soleimani on 3 January by the US is a major escalation in the conflict between the US and Iran. It adds considerable new uncertainty to an already unstable region.

The escalation in geopolitical tensions raises important questions for companies in the region about their exposure to increased political risk, and about what things they should be considering in order to ensure the safety and security of their business and people.

Escalation in geopolitical tensions in the region following assassination of Qasem Soleimani on 3 Jan will impact business

Escalation in geopolitical tensions in the region following assassination of Qasem Soleimani on 3 Jan will impact business- There is a predictable increase in aggressive political rhetoric and talk of slide into third Gulf war

- With an unpredictable US president and Tehran angered and frustrated, war could happen. But it is unlikely

- Personal security threat to westerners in the UAE and the wider GCC has not significantly changed

- Iranian retaliation is most likely to be attacks against US military assets or possibly US individuals in Iraq

- There is the possibility of rocket attacks against Saudi Arabian and UAE oil installations or cities by Houthi militia in Yemen. This is a real risk, but not new

- There is an increased risk of cyber attacks

- The more obvious risk to business is the impact on investor appetite in regional projects and other investments

- There is already evidence of the economic risk with bourses down and oil prices spiking

- With government spending slow, this could hit business growth in the region. Although strategic direction unchanged

- It is the Middle East. It is a region that will always have a high degree of political and commercial risk

- Saudi, Egypt and Abu Dhabi are the strong growth markets. Iraq will struggle

Gulf tensions increased

The assassination of Iranian Revolutionary Guard general Qasem Soleimani by the US is a major escalation in the conflict between the US and Iran.

It adds considerable new uncertainty to an already unstable region.

In the days following the killing, Washington and Tehran have both threatened further violence.

In the days following the killing, Washington and Tehran have both threatened further violence.

Tehran has sworn vengeance, leading to fears of an inevitable slide to war. But while both sides have made threats, neither side wants nor can afford a war.

In a US presidential election year, President Trump gains domestic political capital from strong action and rhetoric, but would suffer if he allowed the US to be sucked into a new war in the Middle East, which he has vowed to avoid.

But US policy in the Middle East is confused and it is not clear whether the assassination fits into any wider strategy.

Iran’s economy is suffering from tough economic sanctions and the leadership is facing a domestic backlash.

It has sought to exploit US uncertainty in the region by aggressively seeking to destablise its regional rivals in Iraq, Yemen, Lebanon and Syria while increasing its own influence. But Iran’s leaders know that they cannot afford to push too far as a war with the US would destroy Iran's economy and infrastructure.

War is possible, but unlikely.

The fear is that a miscalculation could spark a conflict. The US has moved 3,000 additional military personnel to the Gulf. This follows a reported increase of about 20,000 US military personnel in the region since June 2019.

It is certain that Iran will strike back against US interests in the region and those of its allies in the region. Iran’s Supreme Leader Ayatollah Ali Khamenei has described the killing as a criminal act and has promised retaliation.

The key question is how and when will Tehran respond.

Iran has a modern arsenal of rockets and missiles. But if it wanted to use them against US forces as part of a reprisal, Iran would risk making matters worse.

Any Iranian retaliation is likely to involve asymmetric war tactics rather than a full-on act of war, such as attacking US ships in the Gulf, which would risk provoking a devastating response. Iran's oil refineries are on the coast and would be easy targets for the vast firepower the US has in and around the Gulf.

How might Tehran retaliate

Militia attacks in Iraq

- Most likely escalation will be attacks against US military and western civilians in Iraq through Shia militia such as Kateb Hezbollah, Asaib Ahl al-haq and the Badr Corps

- This could involve rocket and missile attacks, bombings, killings and kidnappings

- It is likely to be carried out in parallel with political calls against the US in Iraq

Houthi action in Yemen

- Iran-backed Houthi militia in Yemen cold escalate action against Saudi Arabian and UAE forces in Yemen

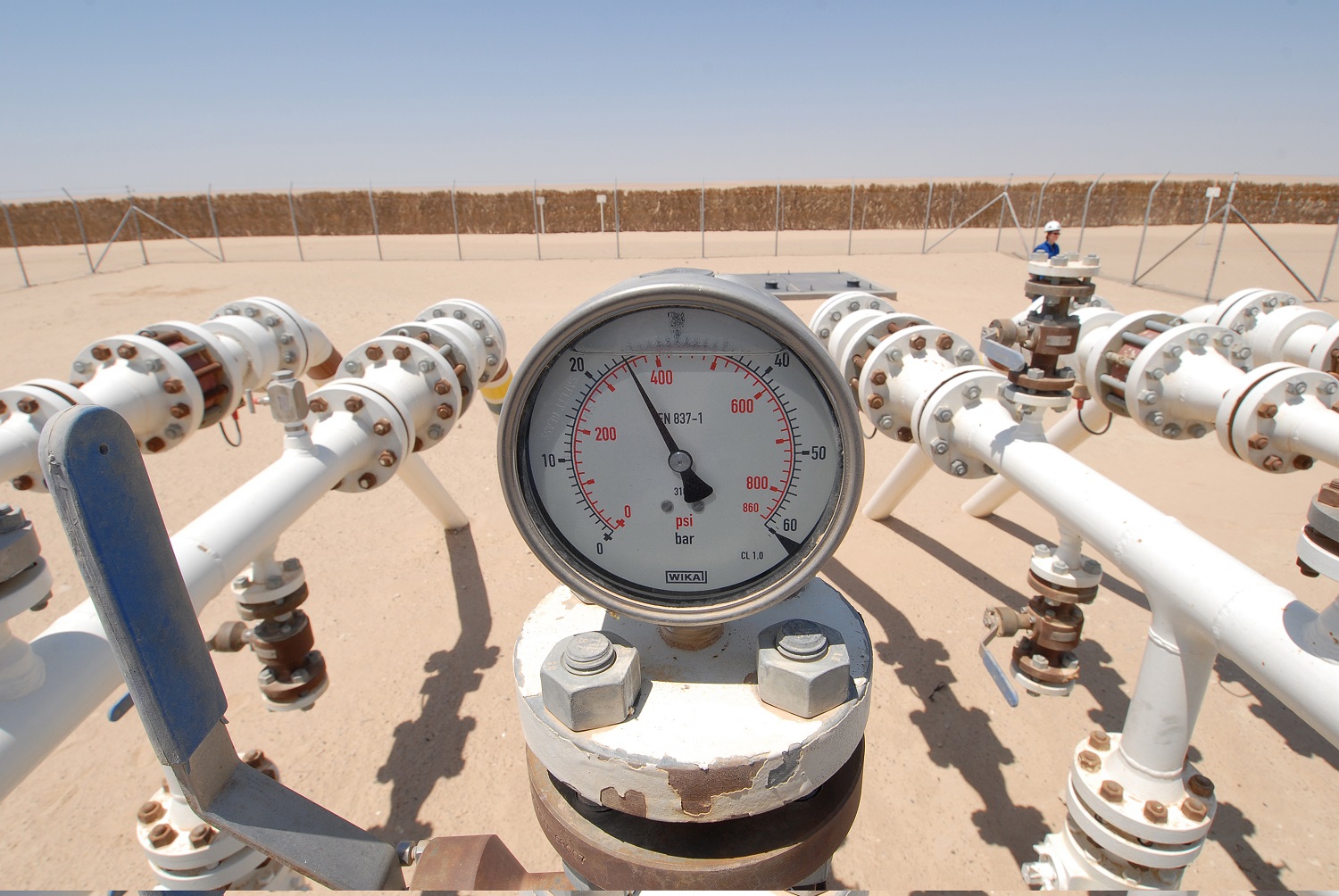

- This could see an increase in rocket attacks against Saudi and UAE cities and oil installations

Terrorism

- Iranian agents could target high-profile US people and interests around the world

- It seems unlikely that Tehran will target western civilians, but it may encourage ‘lone wolf’ actors or sleeper cells to take action

- Yemen Houthis have fired missiles against UAE and Saudi cities and economic assets such as airports and oil installations. This is likely to continue

- There could be military or cyber attacks against GCC oil facilities or to block the Strait of Hormuz, and/or cyber attacks against US interests and those of its allies

Nuclear threat

- The 2015 Joint Comprehensive Plan of Action (JCPOA) nuclear deal is effectively dead

- This will see Iran increasing uranium enrichment

- This could prompt Israeli or US action against Iranian nuclear sites

Personal security

UK and US authorities are advising citizens in the key tourist destinations of UAE and Oman to be vigilant. But for the travel industry, it appears to be business as usual, with normal policies applying for changes and cancellations.

On 4 January, the British Foreign Office updated its travel advice to all countries in the region with the same paragraph: “Following the death of Iranian General Qasem Soleimani in a US strike in Baghdad on 3 January, British nationals in the region should remain vigilant and keep up to date with the latest developments, including via the media and this travel advice.”

The only countries bordering the Gulf that are on the Foreign Office “no-go” list are Iran, Iraq and Yemen.

There are longstanding concerns about terrorism in the UAE. The Foreign Office has been saying for some time that an attack is likely, and warns that possible targets include “oil, transport and aviation interests as well as crowded places, including restaurants, hotels, beaches, shopping centres and mosques”.

The US embassy in the UAE says: “US citizens are strongly encouraged to maintain a high level of vigilance and practice good situational awareness.”

For Qatar and Oman, the Foreign Office says: “Terrorist attacks can’t be ruled out. Attacks could be indiscriminate, including in places visited by foreigners.”

Economic impact

The economic impact for the region has already been felt.

When stock markets opened on 5 January, bourses around the region plunged. It is likely that investors will remain spooked long into 2020 and this will be a drag on private sector activity at a time when the region’s non-oil economy is forecast to drive economic growth.

Over the past five years, regional governments have been working hard to restructure and reform their economies so that they are less dependent on oil and gas and more attractive for private sector investment.

Those efforts were expected to produce results in 2020, with the IMF predicting more rapid growth in key markets such as Saudi Arabia and the UAE.

Oil GDP may fare better. Rising tensions typically means an increase in oil prices, which will benefit oil-exporting countries. The problem is the potential oil price windfall comes with other negative economic consequences.

Impact on energy sector

Fears that Iranian reprisals will further destabilise the region and disrupt Middle East oil supplies saw oil prices jump about 4 per cent in the immediate aftermath of the news of Soleimani’s killing. Oil prices gained about $3 a barrel on 3 January in spite of a broader sense that global oil markets face an oil surplus in 2020.

Unlike the short-term spike in oil prices that followed the attacks against Saudi oil facilities in 2019, this latest incident is likely to add a security-risk premium to oil prices for the foreseeable future.

US independent oil company stocks such as Apache and Devon saw 3-6 per cent bumps, while the supermajors were trading flat.

Saudi Aramco was down 1.7 per cent, however, on 5 January, hitting SR34.55 ($9.21) a share, its lowest level since it started trading last month after a record initial public offering (IPO). Aramco was trading above its IPO price of SR32 a share, but was down 10.7 per cent from a high of SR38.70 on 31 December.

While a risk premium is being priced into assets such as oil, safe haven assets are benefitting. The US 10-year Treasury yield is -5bps at three week lows, while gold has accelerated its rally, and the yen is the outperformer of the major forex.

Impact on regional stock markets

When stock markets opened on 5 January, bourses around the region plunged.

- Saudi Arabia (Tadawul) down 2.4 per cent

- Abu Dhabi down 1.4 per cent

- Dubai Financial Market down 3 per cent

Gulf dispute

Despite signs in December of a thaw in the GCC dispute between Qatar and the UAE, Saudi Arabia, Egypt and Bahrain, any improvement in relations still seems distant.

Prior to the Soleimani killing, Qatar is reported to have had talks with Saudi Arabia. But no negotiations have taken place with the UAE.

The emir of Qatar turned down an invitation to attend the annual GCC summit in Riyadh in December.

All six GCC capitals have called for a de-escalation of tension following Soleimani’s assassination. But media in Saudi Arabia has been quick to highlight the possible involvement of the US’ Al-Udeid air base in Qatar in the drone strike.

Iran nuclear deal

Tehran said on 5 January that it will no longer comply with the restrictions on its nuclear programme that it agreed to as part of the Joint Comprehensive Plan of Action (JCPOA) in 2015.

According to a report by the semi-official Fars News Agency on 5 January, Iran will no longer abide by any restrictions on its nuclear operations. This includes enrichment capacity, levels of enrichment, and research and development.

"Iran will continue its nuclear enrichment with no limitations and based on its technical needs," a statement said.

However, the statement did not say that Iran was actually withdrawing from the agreement and it added that the country would continue to co-operate with the UN's nuclear watchdog, the IAEA.

Iran, it said, was ready to return to its commitments once it enjoyed the benefits of the agreement. Correspondents say this is a reference to its inability to sell oil and have access to its income under US sanctions

Proponents of the JCPOA say that it helped to avert an imminent war

Before it was signed in 2015, there were growing fears over Tehran's nuclear ambitions and fears that Israel might attack Iran's nuclear facilities.

Since the US withdrawal from the agreement in 2018, Iran has successively breached key constraints of the deal. It now appears that Tehran intends to drop out of the agreement altogether.

The key question is what it does next. Will it increase its level of uranium enrichment? Or will it continue to abide by enhanced international inspection measures?

The other parties to the 2015 deal, the UK, France, Germany, China and Russia, have tried to keep the agreement alive since the US withdrawal.

On 5 January, German Chancellor Angela Merkel, French President Emmanuel Macron and British PM Boris Johnson released a joint statement urging Iran to drop measures that go against the deal.

"We are ready to continue talks with all parties in order to contribute to de-escalating tensions and re-establishing stability in the region," they said.

| This article has been unlocked to allow non-subscribers to sample MEED’s content. MEED provides exclusive news, data and analysis on the Middle East every day. For access to MEED’s Middle East business intelligence, subscribe here |

You might also like...

Red Sea Global awards Marina hotel infrastructure

18 April 2024

Aramco allows more time to revise MGS package bids

18 April 2024

Morocco tenders high-speed rail project

18 April 2024

A MEED Subscription...

Subscribe or upgrade your current MEED.com package to support your strategic planning with the MENA region’s best source of business information. Proceed to our online shop below to find out more about the features in each package.