This month's Agenda also includes: Saudi Arabia transforms mining sector

Register for MEED's guest programme

There was a surge in mergers and acquisition (M&A) activity in the global mining sector in 2023, extending a period of consolidation in the industry that began in the previous decade.

The total value of M&A deals in the industry increased by 75% compared to the previous year, to reach $121bn, according to a report by GlobalData. The number of M&A transactions grew 5% year-on-year to 1,526, while the number of mega deals – which are defined as deals with a transaction value of $1bn or more – stood at 16.

The Asia-Pacific region, excluding China, recorded the highest M&A deal value, surpassing North America as the leading region. Despite this, North America maintained its leadership position in terms of deal volume.

GlobalData attributes the increase in M&A activity to companies seeking to position themselves favourably amid disruptive threats in the industry.

Major deals

The year’s biggest mining M&A deal was recorded in December, when Japanese steelmaker Nippon Steel announced its $14.98bn takeover of Pittsburgh-based United States Steel.

In November, Swiss commodities giant Glencore announced it will acquire a majority 77% stake in Elk Valley Resources, the steelmaking coal business of Canadian miner Teck Resources. The transaction is valued at $6.93bn, making it the second-biggest deal of 2023.

In November, Swiss commodities giant Glencore announced it will acquire a majority 77% stake in Elk Valley Resources, the steelmaking coal business of Canadian miner Teck Resources. The transaction is valued at $6.93bn, making it the second-biggest deal of 2023.

Nippon Steel Corporation will acquire a 20% stake in Elk Valley Resources, while South Korea’s Posco will take 3%.

Within months of being established, Saudi Arabia’s Manara Minerals entered into a transaction in July with Brazilian mining major Vale to become a 10% shareholder in its $26bn subsidiary, Vale Base Metals.

Manara Minerals teamed up with investment firm Engine No 1, which took a 3% stake in Vale Base Metals. The $3.4bn transaction was the third-biggest M&A deal in 2023.

Manara Minerals was formed in January 2023, when Saudi Arabian Mining Company (Maaden) signed a joint-venture agreement with the kingdom’s Public Investment Fund (PIF) to establish a firm that would invest in mining assets globally. Maaden owns a 51% stake and the PIF holds the other 49% in the company.

Manara Minerals aims to invest in iron ore, copper, nickel and lithium projects as a non-operating partner, taking minority equity positions.

In another key deal, Australia’s MMG entered into a share purchase agreement to acquire the parent company of Botswana’s Khoemacau copper mine, with a deal value of $1.8bn.

Prominent themes

Prominent themes

Among all mining commodities, gold continued to account for the largest share of M&A activity in 2023, in line with the trend observed in 2022, according to the GlobalData report. Last year, there were 375 gold asset-related deals, with a combined value of $49bn.

The report identified energy transition as the most prominent theme driving M&A deal value in 2023.

The industry is facing headwinds from stricter regulatory, social and environmental requirements when it comes to obtaining licences to develop and operate mining operations. In response, the sector is embracing the shift to a green economy and net-zero emissions.

Most mining companies recognise the need to develop more environmentally friendly mineral exploration technologies to improve relations with local communities and advance mine development.

The estimated $17bn-worth of energy transition-themed M&A transactions last year demonstrates this commitment to a cleaner, greener future by mining companies globally.

The positive momentum of M&A activity is expected to continue into 2024. This year will likely once again see mergers of equals; major mining producers acquiring small producers to strengthen their near-term production profiles; and the strategic acquisition of high-quality, long-life development projects to bolster producers’ development pipelines.

It is also expected that mining companies will continue to prioritise projects that can increase their exposure to critical minerals, including copper, nickel, cobalt and lithium deposits – all of which are an integral part of the global electrification transition that is under way.

You might also like...

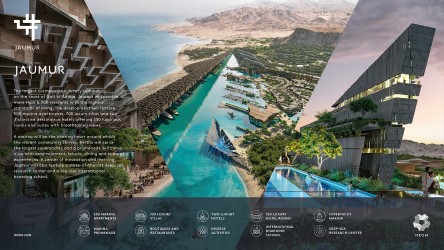

Neom appoints architect for Jaumur

09 May 2024

Gulf plans GCC-wide tourist visa by end-2024

09 May 2024

A MEED Subscription...

Subscribe or upgrade your current MEED.com package to support your strategic planning with the MENA region’s best source of business information. Proceed to our online shop below to find out more about the features in each package.

Saudi Arabia transforms mining sector

Saudi Arabia transforms mining sector