State-owned oil company working on four major projects

Oman Oil Company will need to borrow upwards of $6bn in 2017 to support its capital expenditure plans.

It is tendering four major projects through subsidiaries, and is expected to debt finance all of them:

- Oman Gas Companys (OGC) Salalah liquefied petroleum gas (LPG) plant

- Salalah Methanol Companys ammonia plant

- Oman International Petrochemical Industry Companys (Ompet) polyester plant in Sohar

- Duqm Refinery & Petrochemical Industries Companys refinery.

The $660m club loan deal for Salalah LPG project is well underway, and should reach financial close in early 2017. A group of five banks, including Bank Muscat, Ahli Bank of Oman, Japans Mitsubishi UFG and two European banks is set to finance the $750m project.

The LPG plant is expected to produce 153,000 tonnes a year (t/y) of propane, 115,000 t/y of butane and 59,000 t/y of condensate, extracted from LPG from the nearby Salalah gas field.

US-based CB&I and the UKs Petrofac are the bidders for the engineering, procurement and construction (EPC) contract, after carrying out the front-end engineering and design (feed) study.

Another subsidiary, Salalah Methanol, has contacted local, regional and international banks regarding a loan for its ammonia plant. Including refinancing of existing debt and $430m for the new project, the total deal will be more than $700m, according to one banking source. It could also reach a financial close in the first half.

Six technical bids for the 1,000 tonnes a-day plant are understood to have been submitted in May 2016.

Ompet received bids at the beginning of 2016 to build a Sohar plant with the capacity to produce 1.1 million tonnes a year (t/y) of PTA and 500,000 t/y of polyethylene terephthalate (PET) capacity. This will have similar financing needs but has made less progress with arranging finance, according to the banking source.

Ompet is a joint venture of Oman Oil Company (OOC), the local Takamul Investment Company and South Koreas LG Corporation.

The largest project will Duqm refinery, with a capacity of 230,000 barrels a day, and expected to cost $5.5bn. Kuwait Petroleum International replaced Abu Dhabis International Petroleum Investment Corporation (IPIC) as OOCs co-investor in the project, and main EPC bids were invited in November 2016.

Due to the change in equity investor, an estimated $4bn finance deal has been delayed, and is expected in the second half of 2017.

The financing needs of OOCs investment plans could be challenging to meet given tighter regional liquidity and recent sovereign downgrades of Oman.

The total equity needs of the four projects are also estimated at around $2bn, split between OOC and its partners.

OOC borrowed $1bn in 2016 through subsidiary Oman Oil Company Exploration & Production. It was also in talks with banks over extending a $1.85bn loan secured in 2014.

You might also like...

Aramco allows more time for MGS package revised prices

18 April 2024

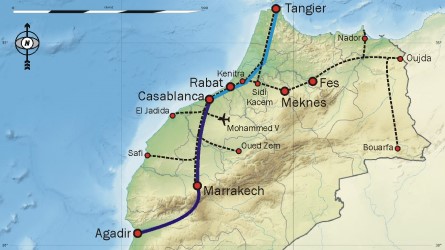

Morocco tenders high-speed rail project

18 April 2024

Egypt resumes power cuts

18 April 2024

Petrofac awards carbon capture sub-contract

18 April 2024

A MEED Subscription...

Subscribe or upgrade your current MEED.com package to support your strategic planning with the MENA region’s best source of business information. Proceed to our online shop below to find out more about the features in each package.